Thanksgiving Weekend Update

The House of Representatives and the Senate return to Capitol Hill for Committee business and floor voting this week.

The Wall Street Journal adds

Lawmakers return to work this week with a to-do list that includes passing a critical government-funding bill, solidifying access to same-sex marriage and setting priorities for the U.S. military before the start of the new Congress next year.

Other issues emphasized by Democrats, including passing a ban on the sale of assault-style weapons, are a long-shot given their narrow majority in the Senate. Most legislation requires 60 votes to advance in the Senate. In addition, lawmakers are discussing raising the federal debt ceiling, which limits how much the government can borrow.

Congress faces a Dec. 16 deadline to pass legislation that would continue funding the federal government; failure to do so could result in a partial shutdown. Lawmakers must decide whether to approve a short-term bill or reach a deal on more-detailed legislation that would fund the government for the full fiscal year.

The Senate also will be considering the National Defense Authorization Act, which typically includes government procurement law changes.

Tomorrow, the Federal Employee Benefits Open Season will reach its clubhouse turn with two weeks left to go. Although not a part of the Open Season, Federal News Network reports an important development concerning the Federal Employees Long Term Care Insurance Program (FLTCIP.

Those looking to enroll in the FLTCIP will soon have to wait a couple of years before applying.

The Office of Personnel Management said it will suspend all new applications to the program starting on Dec. 19. The suspension will last for the next two years, but those who apply ahead of the start date may still see their applications go through. During that time, current FLTCIP enrollees cannot apply to increase their coverage. The suspension will otherwise not affect the coverage of current enrollees.

* * *

The contract for the insurance program, with John Hancock Life and Health Insurance Company, typically lasts seven years before getting a renewal. The program normally gets a premium hike each time the contract turns over. During the open period for new contract proposals earlier this year, only the current underwriter John Hancock submitted a bid. The current FLTCIP contract will expire on April 30, 2023.

The upcoming suspension on applications will allow OPM “to assess the benefit offerings and establish sustainable premium rates that reasonably and equitably reflect the cost of the benefits provided,” the agency said in a Nov. 18 notice. OPM added that it will only suspend applications when it is in the best interest of the program.

Many are eligible to apply for FLTCIP coverage, including federal employees, U.S. Postal Service employees and annuitants, as well as active and retired members of the uniformed services, and qualified relatives of feds. John Hancock has historically sponsored the program, and Long Term Care Partners, LLC, has administered it.

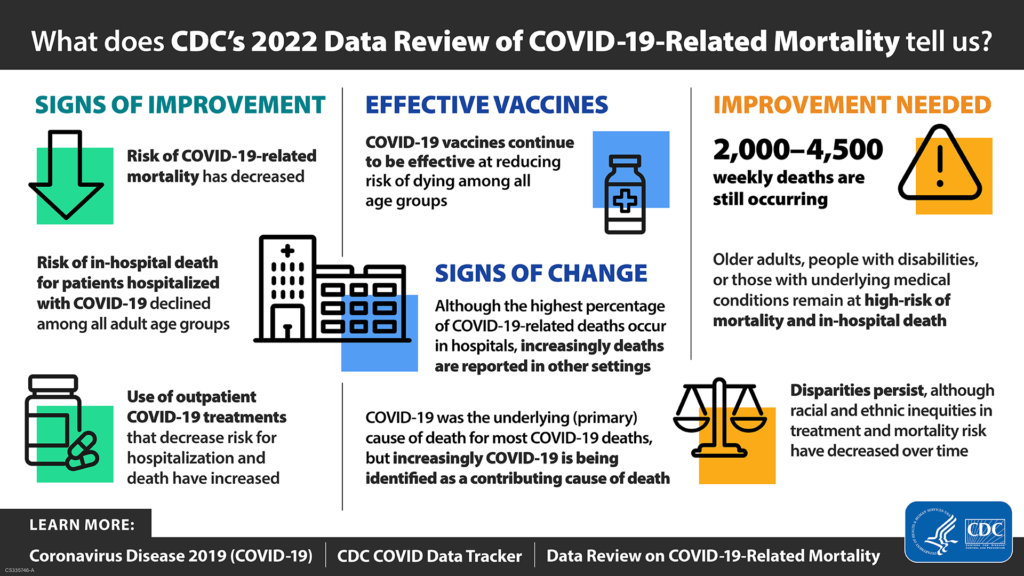

From the Omnicron and siblings front, the National Institutes of Health announced

Reporting a positive or negative test result just became easier through a new website from the National Institutes of Health. MakeMyTestCount.org, developed through NIH’s Rapid Acceleration of Diagnostics (RADx®) Tech program, allows users to anonymously report the results of any brand of at-home COVID-19 test.

COVID-19 testing remains an essential tool as the United States heads into the holiday season and people navigate respiratory viruses. While taking a rapid COVID-19 test has become commonplace, test results are not often reported. COVID-19 test results provide valuable data that public health departments can use to assess the needs and modify the responses in the local community, the state or the nation.

Lab tests have a well-established technology system for sharing test results. RADx Tech has been working on a system to standardize test reporting for at-home tests in a secure manner. The MakeMyTestCount.org website is built on this system for logging test results.

The Wall Street Journal tells us

U.S. life insurers paid a record $100 billion in 2021 in death benefits, fueled by another year of Covid-19 deaths, an industry trade group said.

Payouts rose 11% in 2021 to $100.19 billion, most likely due to the pandemic, according to the American Council of Life Insurers. The increase was on the heels of a 15% year-over-year rise in 2020, when death-benefit payments totaled $90.43 billion.

The ACLI compiles data from annual filings by insurers to state insurance departments. Given limitations in the filings, the group can’t break down causes of death, but it is reasonable to attribute the bulk of the increases to the pandemic, said Andrew Melnyk, ACLI vice president of research and chief economist.

The year-over-year increases are among the largest since the 1918 flu pandemic, when payments surged 41%. They are far above the 4.9% average from 2011 to 2021, the ACLI said.

From the No Surprises Act front, Healthcare Dive reports

House lawmakers expressed their discontent with a final rule on surprise billing and urged federal regulators to make changes.

House Ways and Means Committee Chairman Richard Neal, D-Ma., and ranking member Kevin Brady, R-Texas, sent a letter to HHS Secretary Xavier Becerra and other department heads again expressing disappointment with a much-contested section of the surprise billing ban.

The lawmakers “are severely disappointed to find that the August 2022 final rule violates the No Surprises Act in the same ways as before,” Neal and Brady said in a letter last week.

For Heaven’s sake, Congress should give the revised rule a chance before joining the medical associations in condemning it.

From the public health front, Health Payer Intelligence tells us

The number of Americans with a usual source of care has dropped 10 percent in the last 18 years, with only about three-quarters of people saying they have a regular primary care provider or at least a facility where they know they can access care, according to the Primary Care Collaborative (PCC) and AAFP Graham Center.

The analysis also revealed some health disparities, with folks who are Hispanic, have less than a high school education, are uninsured, and are younger being less likely to have a usual source of care than their counterparts. * * *

“Employers have a very important role to play to ensure that all their employees and their families have ready, convenient access to a usual source of affordable primary care,” said Asaf Bitton, MD, the executive director of Ariadne Labs – Harvard T.H. Chan School of Public Health.

“We applaud those employers who are providing highly accessible virtual and in-person primary care options, and working with preferred provider organizations and health systems to support patients in establishing and maintaining these crucial primary care relationships.”

Amen to that sentiment.

STAT New reports

Cardiovascular disease is responsible for about one in five deaths in women in the U.S., more than any other cause — including all forms of cancer combined. Black women like Shields are particularly vulnerable: In the U.S., Black adults are substantially more likely to die from heart disease than their white, Hispanic, or Asian or Pacific Islander counterparts.

To try to reduce deaths from heart disease, health professionals typically use basic risk calculators, which take about a dozen standard data points to predict a person’s likelihood of having a major event, such as a heart attack or stroke, in the next 10 years.

Regardless of their other risk factors, for the most part, patients who are young and female have a very low chance of having a cardiovascular event in the next 10 years, so they are unlikely to get recommendations for serious lifestyle interventions or medication. But they may still be heading down a path to a fatal event later in life.

Some 10 to 15% of pregnancies have at least one complication that is linked to later heart disease. In addition to preeclampsia, these include other forms of gestational hypertension; gestational diabetes; preterm delivery; low birth weight; and placental abruption. People who experience miscarriages and stillbirths are also at greater risk of heart disease. Additional reproductive health conditions — including the early arrival of periods, polycystic ovary syndrome, infertility, and early menopause — have also been linked to increased risk.

These data, however, are all missing from standard cardiovascular disease risk calculators. Some pregnancy complications are listed as part of the comprehensive American Heart Association screening guidelines. But a large national 2014 survey revealed that only 16% of primary care physicians and 22% of cardiologists were using these full guidelines. The failure of health-care providers to screen for these sorts of early warning signs is in keeping with the long-standing pattern in which women’s risk for heart disease is chronically underestimated by medical professionals — as well as by women themselves.

That’s a big bowl of wrong.

From the plan design front, Beckers Payer Issues relates

Providers using EHRs that aren’t enabled for electronic prior authorization and the cost to upgrade to those EHRs are the main barriers preventing automated PA, according to a Nov. 14 America’s Health Insurance Plans survey.

The health insurance trade group conducted an industrywide survey on “prior authorization practices and gold carding experience of commercial plans” between February and April, according to the report. AHIP received responses from 26 plans, covering a total of 122 million commercial enrollees.

Top barriers to automated prior authorization:

- Provider does not use EHR enabled for electronic PA: 71 percent

- Costly/burdensome for providers to buy/upgrade EHR for electronic PA: 71 percent

- Lack of interoperability between EHR vendors: 62 percent

- Costly for payers to enable PA rules and information to be delivered electronically: 43 percent

- Lack of electronic PA solutions on market: 19 percent

This is a surprising outcome considering how vociferously providers object to prior authorization.