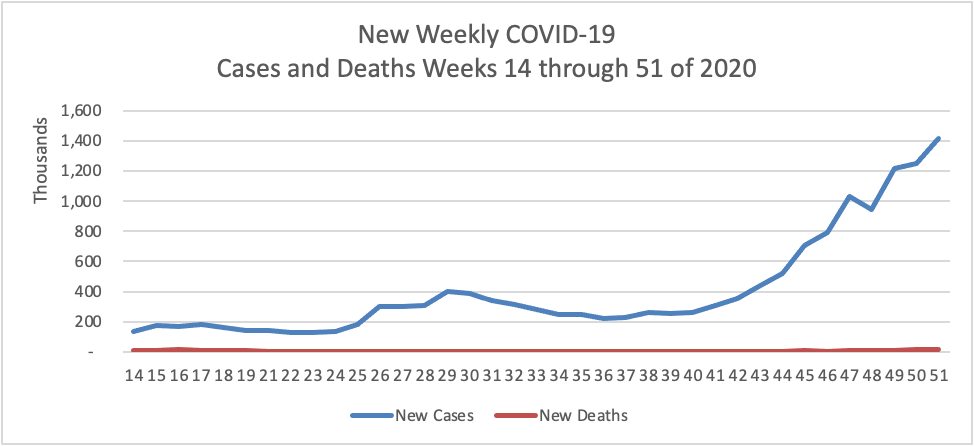

Based on the CDC’s Cases in the U.S. website, here is the FEHBlog’s chart of new weekly COVID-19 cases and deaths over the 14th through 51st weeks of this year (beginning April 2 and ending December 23; using Thursday as the first day of the week in order to facilitate this weekly update):

and here is the CDC’s latest overall weekly hospitalization rate chart for COVID-19:

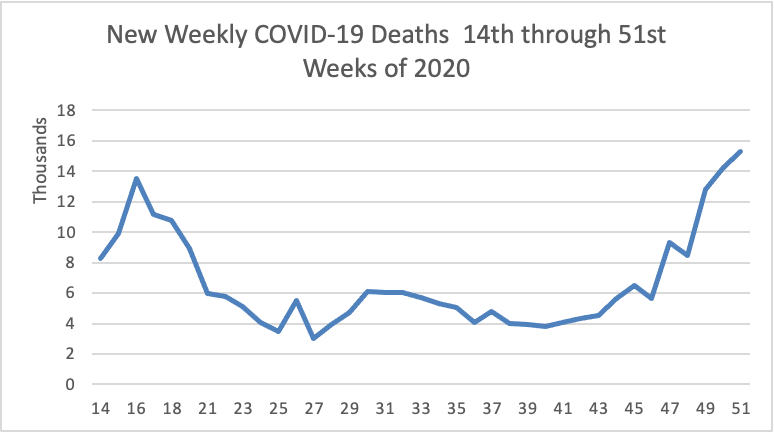

The FEHBlog has noted that the new cases and deaths chart shows a flat line for new weekly deaths because new cases greatly exceed new deaths. Accordingly here is a chart of new COVID-19 deaths over the period (April 2 through December 23):

The latest CDC FluView will be available on Monday December 28. Next week the FEHBlog will begin to include COVID vaccines in these charts.

The FEHBlog had planned to start reviewing the Affordable Care Act changes in the Consolidated Appropriations Act, 2021, but because the status of that bill unfortunately is in limbo, he instead will note two other Congressionally passed bills that are expected to receive the President’s signature:

The McCarran-Ferguson Act of 1945 “limited the application of [federal] antitrust laws to the business of insurance as long as and to the extent state law regulated the business of insurance. However, if states would not regulate insurance, the Sherman and Clayton Acts, as well the Federal Trade Commission Act still applied.” Needless to say the States with the assistance of the National Association of Insurance Commissioners made sure that the States did not unwittingly create such a regulatory gap. In any event. the McCarran- Ferguson Act continued to apply federal anti-trust law, specifically the Sherman Act of 1896, to prohibit “any agreement to boycott, coerce, or intimidate, or act of boycott, coercion, or intimidation” (15 U.S.C. Sec. 1013).

H.R. 1418 adds to the McCarran- Ferguson Act a further exception for health insurance, dental insurance and limited scope dental benefits. In other words health insurers and dental insurers will be subject to both federal and state laws against restraint of trade. The garden variety exceptions to extension of federal anti-trust law appear quite narrow to the FEHBlog.

“(A) to collect, compile, or disseminate historical loss data; (B) to determine a loss development factor applicable to historical loss data; (C) to perform actuarial services if such contract, combination, or conspiracy does not involve a restraint of trade; or (D) to develop or disseminate a standard insurance policy form.”

ThinkAdvisor adds

Matt Eyles, president of America’s Health Insurance Plans (AHIP), said in a statement about passage of H.R. 1418 that implementation of the bill would add layers of bureaucracy to health insurers and destabilize markets.

“Removal of this exemption adds tremendous administrative costs while delivering absolutely no value for patients and consumers,” Eyles said.

Consumer Reports put out a commentary welcoming passage of H.R. 1418.

“The antitrust exemption has essentially allowed health insurers to act as a monopoly, making demands in lockstep on the terms they will offer consumers and health care providers,” the advocacy organization said in a comment on bill passage. “The resulting squeeze puts pressure on providers to cut corners on service in order to increase the profits the health insurers can extract.”

How much can insurers extract when those profits are strictly regulated by the Affordable Care Act?

This bill, which the FEHBlog previously has mentioned, requires HHS’s Office for Civil Rights to consider whether the covered entity or business associate has adequately demonstrated that it had, for not less than the previous 12 months, recognized security practices in place, when imposing penalties or other remedies for HIPAA Security Rule violations.

The bill defines “Recognized security practices” to mean

the standards, guidelines, best practices, methodologies, procedures, and processes developed under section 2(c)(15) of the National Institute of Standards and Technology Act, the approaches promulgated under section 405(d) of the Cybersecurity Act of 2015, and other programs and processes that address cybersecurity and that are developed, recognized, or promulgated through regulations under other statutory authorities. Such practices shall be determined by the covered entity or business associate, consistent with the HIPAA Security rule (part 160 of title 45 Code of Federal Regulations and subparts A and C of part 164 of such title).

The bill expressly does not create liability for HIPAA covered entities and business associates which decide not to adopt such practices. The bill is retroactive to the effective date of the 21st Century Cures Act of 2016.

In other healthcare legal news:

- Reuters reports that on December 23, 2020, a federal district judge in Maryland “blocked a last-minute Trump administration rule aimed at lowering drug prices as of next week. The rule, scheduled to take effect on Jan. 1, would have tied reimbursements for 50 drugs by Medicare, a U.S. government insurance program, to the lowest prices paid by certain other countries. U.S. District Judge Catherine Blake in Maryland ruled that the administration had rushed the rule without giving the public a chance to comment, in violation of federal law.” Case No. 1:20-cv-03531 (D. Md). The temporary restraining order is effective for 14 days.

- MedCity News reports that

The American Hospital Association, along with several other organizations, filed an emergency stay of enforcement motion to prevent the Department of Health and Human Services’ hospital price transparency rule from going into effect Jan. 1. The rule requires each hospital operating in the U.S. to make public pricing information, including the prices they negotiate with commercial health insurers. Last week, the Centers for Medicare and Medicaid issued a bulletin announcingits plans to audit a sample of hospitals for compliance with the rule starting in January.

The motion was filed with the U.S. Court of Appeals for the D.C. Circuit in its appeal of a lower court order affirming the legality of this rulemaking (Case No. 20-5193). In its opposition to this motion, the Justice Department observed that

This Court granted plaintiffs’ request for an expedited briefing and argument schedule to “allow the Court to hear and decide this case before” January 1, 2021. Pls. Mot. to Expedite, at 5 (July 3, 2020). The Court is likely to rule on the merits of this appeal imminently, thereby resolving plaintiffs’ legal challenge. Should the Court affirm the district court’s rejection of plaintiffs’ claims, plaintiffs would not be entitled to any relief, including a stay of the agency’s rule. Should the Court agree with plaintiffs’ legal challenge, by contrast, plaintiffs would be entitled to appropriate relief.

The FEHBlog will keep an eye out for this opinion next week.